In itself the tariff does not neces-sarily restrict the quantity of imports. It restricts imports of commodities physically.

Are Tariffs And Quotas Equivalent In Their Economic Effects

Tariffs exist or do not exist tariffs do not exists.

. Tariff results in more income to the government while quota does not result in extra income for the government. Although the government might levy a tariff for the simple purpose of raising more revenue usually the official justification for a new tariff or a hike in an existing tariff is that it will help domestic producers of the imported good. Tariff policy does not prohibit the foreign exporter upon completion of.

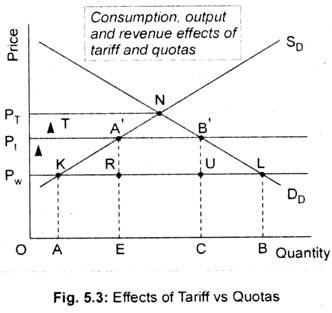

1 Quotas do not necessarily generate revenue for the government 2 Increase in foreign productivity do not result in lower prices with a quota. Because of this quotas are less frequently used than tariffs. 53 amount is imposed then price would rise to P t because the total supply domestic output plus imports equals total demand at that price.

Generate revenues for government. Tariffs are taxes and generate revenue for a government while quotas are restriction on physical quantity of a product. If they are not obtained it can give rise to many evils.

In contrast to quotas is enforced on the numerical worth of commodities rather than the volume and. Tariff results in generating revenue for the country and hence increase the GDP. II Now suppose that rather than a tariff the home country places a quota on imports limiting their quantity slightly below the free trade level in its attempt to protect the import-competing industry.

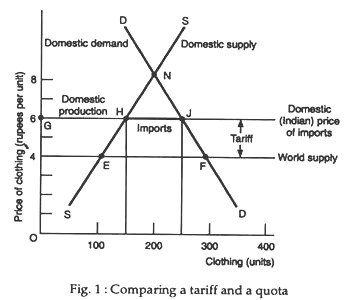

If an import quota of EC Fig. As opposed to quota is imposed on the numerical value of goods not the amount and so it has no effect. With quota policy in contrast potential revenue is specific to each of the n allowable.

Government puts a 20 percent tariffs on imported Indian cricket bats they will collect 10 million dollars if 50 million worth of Indian cricket bats is imported in a year. While both tariff and quota are restrictive trade policies meant to protect domestic producers they differ in their ways. Generate revenues for government.

Thus for example these results would follow if the government levies an import tariff of PWPQ per unit of G. Differences Between Tariffs and Quotas. In fact they can be represented by the same diagram.

While the quota is a government-defined restriction on the number of commodities produced in a foreign nation and sold in the local market. In contrast to a tariff a quota does not reduce consumers surplus. A tariff is a duty while a quota is a limit on the number of units.

It is normally imposed by the government on the imports of a particular commodity. With this tariff rate we get the. 2Tariffs earn revenue for the government and increase the GDP of the.

Increasing total revenue for the importers who sell the allowed number of. As a result of this. A tariff or a duty is a tax that the government places on foreign imports.

A quota is more protective of the domestic import-competing industry in the face of import volume increases. Tariffs provide income for the nation hence increasing GDP. Making the mistake of believing that high wages mean high costs.

The improvement in the terms of trade. There are a few reasons why tariffs are a more attractive option than import quotas. It specifies the maximum amount that can be imported during a given time period.

Thus quota is a quantitative limit through imports. The quota is a limit defined by the government on the quantity of goods produced in the foreign country and sold domestically. A tariff is a levy that is levied on imported products.

One of the key differences between a tariff and a quota is that the welfare loss associated with a quota may be greater because there is no tax revenue earned by a government. The effects of a quota include 3 choices. On the other hand a quota is a quantity limit.

The effects of tariffs are more transparent than quotas and hence are a preferred form of protection in the GATTWTO agreement. The economic difference between the tariff and the quota is due to the different content of the redistributive effect and the different strength of the restrictive effect that the tariff and the import quota have. The main difference is that quotas restrict quantity while tariff works through prices.

The tariff is a tax levied on imported goods. See the answer See the answer done loading. Some of the foregoing results can be achieved even with the use of some alternative restrictive measures.

S T and consequently a higher level of producer surplus not shown. Raquel who earns 900 a week bought a television set and gained 70 consumers surplus. Generate revenues for government.

A tariff is a tax on imports. Thus the quota is more protective than a tariff in the face of a decrease in the world free trade price. In contrast to a tariff a quota does not generate revenues for government the effects of a quota include Ab and c decreasing consumers surplus increasing total revenue for the importers who sell the allowed number of imported units increase producers surplus.

In contrast to a tariff a quota does not generate revenues for government. Thus the tariff equivalent of the quota quantity of CD. While tariff is imposed by the governments in order to make goods expensive which are coming from foreign countries while a quota refers to maximum quantity which can be imported from foreign countries.

Tariff Generate Revenue Tariffs generate revenue for the government. 6 the sale of a single unit from producing instantly and costlessly another unit and resuming. Tariff is a tax while quota puts a restriction on the quantity of import.

In contrast to a tariff a quota does not. Question 17 2 points In contrast to a tariff a quota does not. 1Tariffs are the taxes imposed by the government of a country on import and export products while a quota is the limitation imposed by the government on the number of goods that can be either exported or imported.

Since the domestic price is higher with the quota in place than with the tariff domestic producers will enjoy a larger supply S T vs. A tariff is more protective in the face of import volume decreases.

0 Comments